What Is the 15-Year Roof Rule in Florida?

Insurance

Metal Roofing

Roof Replacement

Roofing

September 23,2025

If you are a Florida homeowner, the “15-year roof rule” is a term you need to understand. This rule directly affects your home insurance options and costs. This guide will explain what the rule means, how it impacts you, and what steps you can take to protect your home and your wallet.

Understanding the Law vs. the Reality

Florida law states that an insurance company cannot refuse to issue or renew a policy for a home simply because its roof is less than 15 years old. If your roof is 15 years or older, the law still provides a path to coverage: you can hire a licensed inspector to certify that the roof has at least five years of useful life remaining. With that positive inspection, an insurer must offer you a policy.

However, the practical reality in Florida’s insurance market is more complex. In response to rising costs and storm-related risks, many insurance companies are leaving the state or creating strict new guidelines that make it difficult and expensive to find coverage for older roofs, even with a positive inspection.

The Reality Check: While the law provides a path to coverage, many insurers make it too expensive or difficult to obtain for roofs over 15 years old.

What Are the Practical Challenges of Insuring an Older Roof?

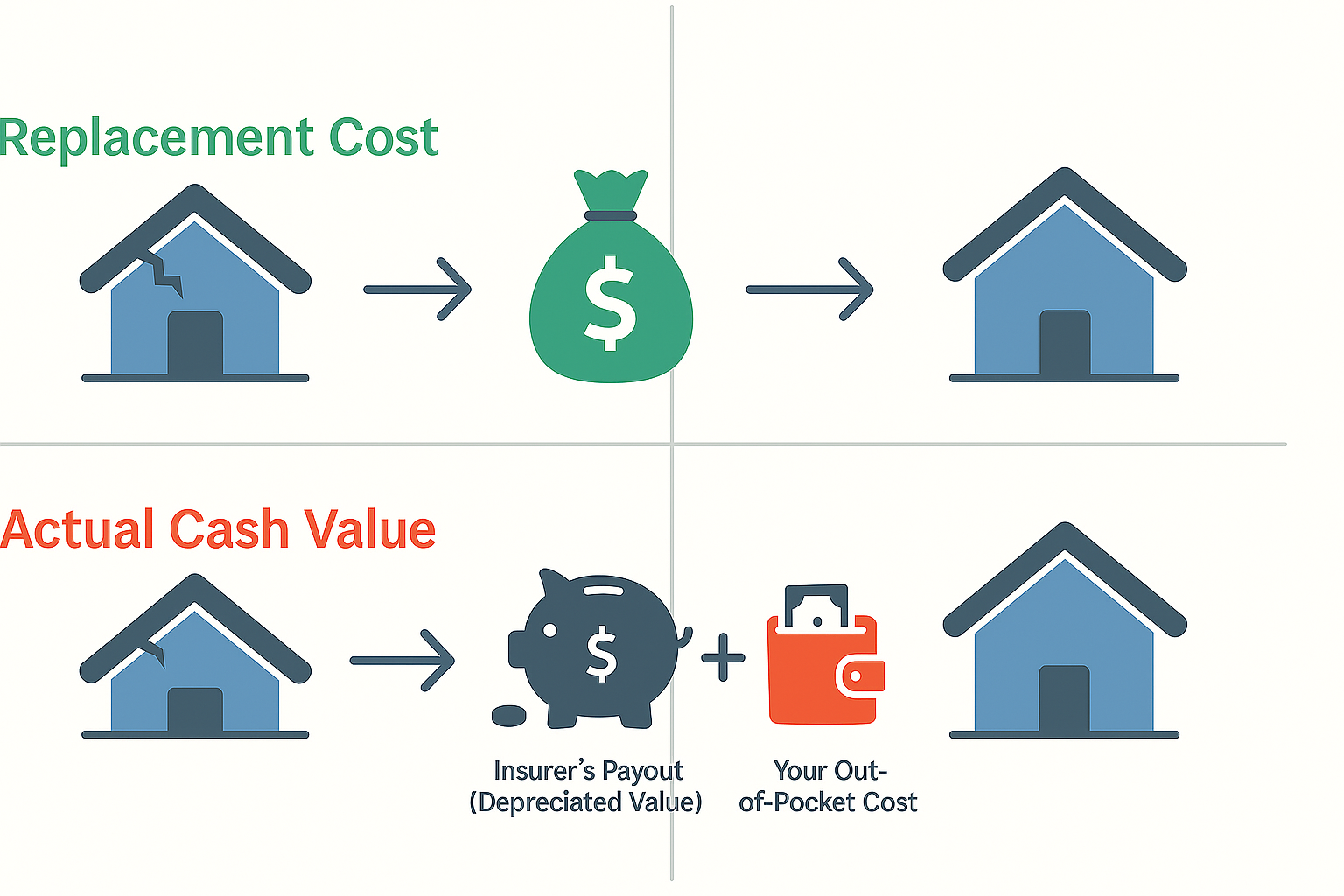

Once your roof passes the 15-year mark, you will face several clear challenges. Your insurance options will narrow significantly, and you can expect premiums to be 30-40% higher than for a home with a newer roof. Many homeowners are forced into a policy with Citizens Property Insurance, Florida’s state-backed insurer of last resort. You will also almost certainly need to pay for a professional roof inspection, which costs between $150 and $500, just to be considered for coverage. Furthermore, the policy you are offered may be for “actual cash value” (ACV) instead of “replacement cost.” This is a critical distinction that can have major financial consequences.

Warning: Actual Cash Value vs. Replacement Cost. Be cautious of “Actual Cash Value” (ACV) policies. They pay less on claims by factoring in your roof’s age and wear (depreciation), leaving you with significant out-of-pocket costs for a replacement.

How Does Your Roof Type Affect Insurance?

The type of roof you have plays a major role in how you will face these challenges, as insurers assess risk based on materials and their expected lifespan in Florida’s harsh climate. They scrutinize asphalt shingle roofs the most, becoming wary around the 15-year mark as the state’s climate often shortens their lifespan. In contrast, metal roofs are highly favored due to their 40-70 year durability, making coverage much easier to secure. For tile roofs, the focus is not on the tiles themselves, which can last over 50 years, but on the underlayment beneath them. Its replacement, typically needed every 20-30 years, is what insurers consider a full “roof replacement.”

How to Prepare for an Insurance Review

To navigate these challenges, solid documentation is your best defense. When preparing for a review, gather all key documents, such as the building permits from the roof’s installation and the contractor invoices showing the completion date. It is also critical to have a recent professional inspection report certifying the roof’s remaining life, along with clear photos of its current condition and any warranties from the roofing materials

Pro Tip: If you cannot find your original records, a licensed roofer or home inspector can estimate the roof’s age by examining its materials and wear. This report can often be used for insurance purposes.

Navigating Real Estate with an Older Roof

These insurance factors become especially critical when buying or selling a home, where an older roof is a major transactional hurdle.

If you are buying a home, you must be proactive. Call insurance companies for quotes before you finalize the purchase to confirm the property is insurable. You should also budget for a potential roof replacement, which can cost $15,000 to $40,000 or more, and use your inspection period to negotiate with the seller for a new roof or a credit. For those selling a home, an old roof requires a strategic approach. Be transparent about its age in your listing. To attract more buyers and avoid delays, consider replacing the roof before you list, especially if it is over 20 years old. At a minimum, provide a recent professional inspection report to show its condition and be prepared to negotiate on price.

Your Action Plan by Roof Age

- Under 10 years: You are in a good position. Keep your documentation organized and perform regular maintenance.

- 10-15 years: Start shopping for insurance quotes now to understand your future options. Get a professional inspection to document the roof’s condition before it becomes an issue.

- 15-20 years: A professional inspection is essential. Begin budgeting for a replacement and research all your insurance options, including Citizens.

- Over 20 years: Unless it is a tile or metal roof in excellent, well-documented condition, you should actively plan for a replacement. Your insurance options will be extremely limited.

Your Best Strategy for Florida’s Roof Rule

The 15-year roof rule was intended to help homeowners, but the current insurance market has made navigating it a challenge. Your best strategy is to be proactive. Keep excellent records, get regular inspections, and do not wait for a non-renewal notice to act. When it is time for a replacement, consider materials that insurers prefer, like metal. By planning ahead, you will protect your home and give yourself more options in a difficult market. Need help with your roof? Contact us at Foxhavenroof.com We understand Florida’s insurance requirements and can help you navigate both roof replacement and insurance compliance.