The Two-Year Claim Filing Deadline Explained

Insurance

Roof Repairs

Roof Replacement

Roofing

Storm Damage

November 7,2025

When a storm hits, most Florida homeowners know to document the damage and contact their insurer but far fewer realize just how strict Florida’s insurance claim deadlines have become. These deadlines can determine whether a claim is paid or denied, and recent law changes mean that guidance you find online may already be outdated.

Florida law used to give policyholders two years to notify their insurer after a loss, the so-called two-year Florida claims filing deadline. However, legislative updates shortened those timeframes significantly. Today, most property owners have just one year from the date of loss to file an insurance claim.

What Is an Insurance Claim Deadline?

An insurance claim deadline is the legal time limit for reporting property damage to your insurance company. Florida Statute clearly states that if you fail to notify your insurer within this period, your claim is barred. This means that even if your roof claim is valid and fully documented, missing the filing date by one day can result in complete denial.

After a claim is submitted, insurers often request a proof of loss, a formal statement that outlines the extent of the damage and cost of repair. However, many policies often specify their deadlines, often within 60 to 90 days.

Missing the insurance claims deadline can empower your insurer to legally deny coverage. You could also lose the ability to sue, and you would be responsible for all repair costs.

COST ALERT: Missing the Florida insurance claim deadline could cost you thousands of dollars that should have been covered.

How Long Do You Have to File an Insurance Claim in Florida?

Under Florida Statutes, homeowners must file notice of a new or reopened claim within one year from the date of loss, and a supplemental claim (which covers hidden or delayed storm effects) within eighteen months. So, while many homeowners still refer to a two-year Florida claims filing deadline, the real window today is often just half that.

| Type of Claim | Filing Deadline from Date of Loss |

| Initial Insurance Claim | 1 year |

| Supplemental Claim | 18 months |

| Lawsuit Filing (after valid claim) | 5 years |

For hurricane losses, the “date of loss” is the day the storm made landfall, not when the damage was discovered. If Hurricane Ian struck on September 28, 2022, your claim for roof damage from that storm had to be filed by September 28, 2023. In the event that a contractor uncovers additional storm-related issues after repairs begin, that new claim must be reported before the deadline expires. Waiting longer can mean losing eligibility for reimbursement.

CRITICAL TIMING: Florida’s one-year insurance claim deadline starts from the date of loss, not the date you notice the damage.

Why Did Florida Reduce the Two-Year Claim Filing Deadline?

Florida lawmakers shortened the two year Florida claims filing deadline to one year to stabilize the state’s insurance market. Between 2019 and 2023, several major insurers left Florida or went insolvent, largely due to litigation costs and delayed claim filings. The new deadline encourages faster reporting, helps insurers resolve claims quickly, and aims to attract more carriers to the market.

While these reforms may benefit insurers, they create added pressure for homeowners to act quickly. If you delay filing your roof insurance claim, you risk losing all coverage for that damage.

HOMEOWNER WARNING: The shorter filing period benefits insurers but it means homeowners must act fast. Waiting too long can permanently forfeit your right to compensation.

How Long Will Insurance Cover a Roof in Florida?

Your roof remains covered as long as your insurance policy is active and premiums are paid, but coverage depends heavily on the roof’s age and condition. Florida’s 15-Year roof rule introduced important guidelines:

- Roofs under 15 years old cannot be denied coverage based solely on age.

- Roofs older than 15 years may require inspection proving at least five years of remaining life.

- Older roofs might qualify only for Actual Cash Value (ACV) coverage, not full Replacement Cost Value (RCV).

If your roof is aging, you may face higher premiums, inspection requirements, and reduced coverage options. However, no matter the roof’s age, the Florida insurance claim deadline remains one year from the date of loss for any claim for roof damage.

AGE CLARIFICATION: Roof age affects coverage value—not your claim deadline. Even if your roof is 20 years old, you still must file within one year of loss.

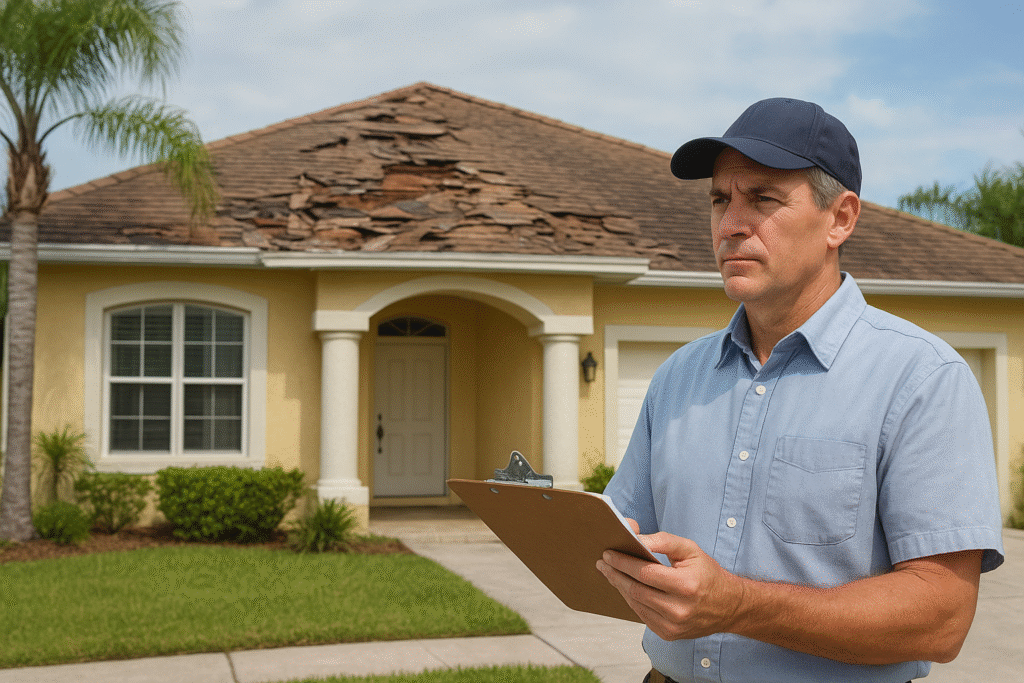

How Should You File a Roof Claim in Florida?

Start by ensuring your safety, documenting visible damage, and reporting the event to your insurer as soon as possible. Provide detailed photos and receipts for any emergency repairs, then schedule a professional inspection from a licensed roofer.

For insurance claims for hurricane damage, the clock starts ticking the moment the storm makes landfall. Wind-driven rain entering through storm-created openings is typically covered, but you’ll need clear documentation linking the storm to the damage.

For non-hurricane events, insurers distinguish between sudden and gradual damage. Coverage applies to sudden and accidental incidents like hail, fallen branches, or torn shingles, but excludes normal wear and tear. If multiple storms cause separate damage, each event triggers its own filing deadline.

What Happens If You Miss the Florida Insurance Claim Deadline?

If you fail to file your roof insurance claim within one year, your insurer can deny it entirely. While you can still attempt to file, late submissions are usually rejected unless extraordinary circumstances apply. Rare exceptions exist—such as active military deployment or proven mental incapacity—but they are difficult to prove.

Once the deadline passes, you lose the right to recover for that damage, even if your claim is legitimate. The best protection is to act fast and document everything immediately after the loss.

NO EXCEPTIONS: There are almost no exceptions for missed deadlines. Filing within one year is the only reliable way to preserve your right to compensation.

How Can Florida Homeowners Protect Themselves?

Preparation is the best defense against missed deadlines and denied claims coverage. Schedule annual roof inspections, document your roof’s condition, and understand your policy’s exclusions and coverage limits. The moment you notice storm damage, report it within 24 to 48 hours and consult a trusted local roofer.

At FoxHaven Roofing, we guide homeowners through every step of the process. We prepare comprehensive repair estimates that meet insurance standards and help ensure all covered damage is compensated. Contact FoxHaven Roofing for a consultation today. Our team combines professional roofing expertise with insurance claim experience to ensure your home stays protected and your claim stays valid.